OR DoR 40N 2023-2026 free printable template

Show details

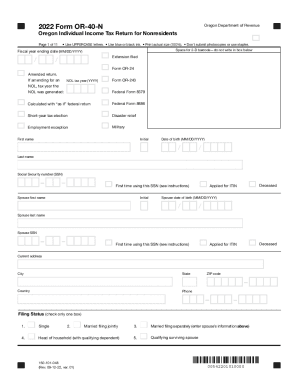

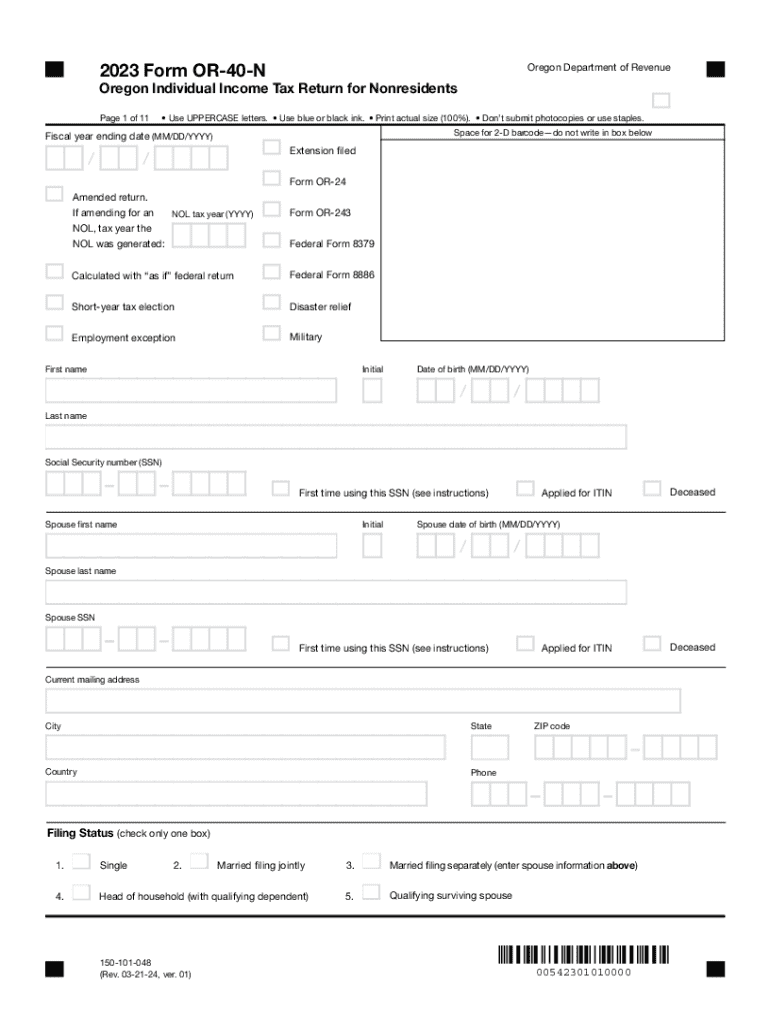

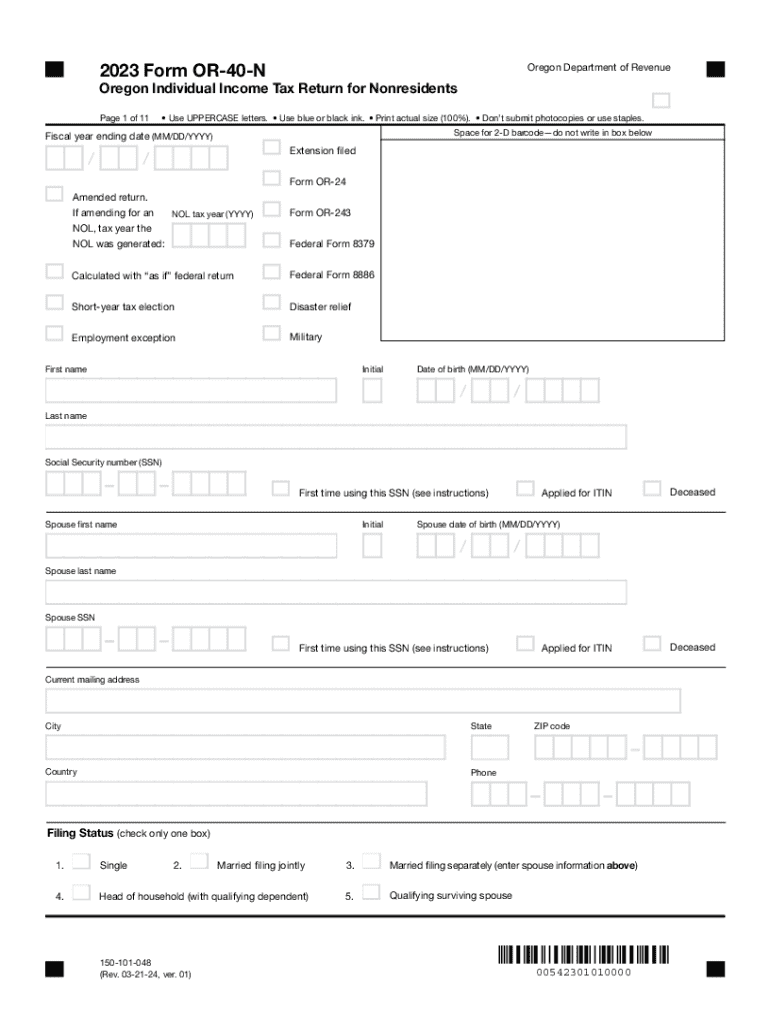

Clear form2023 Form OR40NOregon Department of RevenueOregon Individual Income Tax Return for Nonresidents Page 1 of 11 Use UPPERCASE letters. Use blue or black ink. Print actual size (100%). Dont

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oregon 40n tax return form

Edit your or 40 n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon form 40 2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oregon form 40n income online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oregon form 40 instructions 2025. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR DoR 40N Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oregon form 40 instructions 2024

How to fill out OR DoR 40N

01

Obtain the OR DoR 40N form from the relevant authority or website.

02

Fill in your personal details accurately in the designated fields.

03

Provide any necessary identification numbers or codes as requested.

04

Complete the sections related to the purpose of the DoR and any additional information required.

05

Ensure to double-check all entries for correctness and completeness.

06

Sign and date the form where indicated.

07

Submit the form either electronically or by mailing it to the appropriate office.

Who needs OR DoR 40N?

01

Individuals or businesses who are required to report certain information to the government.

02

Those applying for specific permits or licenses needing the OR DoR 40N.

03

Individuals seeking to rectify or update their existing records with relevant authorities.

Fill

oregon income tax nonresidents

: Try Risk Free

People Also Ask about oregon form 40

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

What is the standard deduction for Oregon income tax?

The state of Oregon offers a standard deduction for its taxpayers. For the 2021 tax year, Oregon's standard deduction allows taxpayers to reduce their taxable income by $2,350 for single filers, $4,700 for those married filing jointly, $3,780 for heads of household, and $4,700 for qualifying widowers.

What is an Oregon Form 40?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

Do I have to file if I made under 12000?

The minimum income amount depends on your filing status and age. In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return. Review the full list below for other filing statuses and ages.

Does everyone have to fill out a 10/40 form?

While people with more complicated tax situations may need more forms and schedules, everyone filing taxes will need to fill out Form 1040 in order to file their taxes.

What is a 10/40 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What are the Oregon state income tax brackets?

Income Tax Brackets Single FilersOregon Taxable IncomeRate$0 - $3,6504.75%$3,650 - $9,2006.75%$9,200 - $125,0008.75%1 more row • 23-Dec-2021

What is the Oregon filing requirement?

You must file an Oregon income tax return if: Your filing status isAnd your Oregon gross income is more thanCan be claimed on another's return$1,100*Single$2,350Married filing jointly$4,700Married filing separately If spouse claims standard deduction. If spouse itemizes deductions. $2,350 -0-4 more rows

Who is exempt from Oregon income tax?

Oregon's personal exemption credit You can't be claimed as a dependent on someone else's return, and. Your federal adjusted gross income isn't more than $100,000 if your filing status is single or married filing separately, or isn't more than $200,000 for all others.

What is the Oregon state income tax rate for 2022?

Oregon Tax Brackets 2022 - 2023 Tax rate of 4.75% on the first $3,750 of taxable income. Tax rate of 6.75% on taxable income between $3,751 and $9,450. Tax rate of 8.75% on taxable income between $9,451 and $125,000. Tax rate of 9.9% on taxable income over $125,000.

What is the Oregon standard deduction for 2022?

The 2022 standard deduction for each filing status is: $2,420 for single or married filing separately. $3,895 for head of household. $4,840 for married filing jointly or qualifying widow(er).

What is a filing requirement?

The minimum amount (or threshold) of income requiring you to file a federal tax return.

Do I need to file a tax return in Oregon?

You are a full-year Oregon resident. You must file an Oregon income tax return. View filing information, or download Form OR-40 instructions.

What is standard deduction for 2022?

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find or 40?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific oregon state tax forms and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in or 40 instructions?

The editing procedure is simple with pdfFiller. Open your oregon 40n return in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit form or 40 n on an iOS device?

Create, edit, and share oregon tax form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is OR DoR 40N?

OR DoR 40N is a specific form used for reporting various financial information to tax authorities in certain jurisdictions.

Who is required to file OR DoR 40N?

Individuals and entities that meet certain income thresholds or engage in specific activities as defined by tax regulations are required to file OR DoR 40N.

How to fill out OR DoR 40N?

To fill out OR DoR 40N, individuals and entities must provide accurate financial data as requested on the form, ensuring to follow any specific guidelines set by the relevant tax authority.

What is the purpose of OR DoR 40N?

The purpose of OR DoR 40N is to collect financial information for tax assessment and compliance purposes.

What information must be reported on OR DoR 40N?

Information that must be reported on OR DoR 40N typically includes income statements, deductions, credits, and other relevant financial details as required by tax authorities.

Fill out your OR DoR 40N online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon State Income Tax Return is not the form you're looking for?Search for another form here.

Keywords relevant to oregon revenue department

Related to 2025 oregon form 40

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.